Your new post is loading...

|

Scooped by

rob halkes

|

From PatientView See here

Long-term assessment of the corporate reputation of the pharmaceutical industry - from a patient perspective PatientView is continuing to provide historical perspectives on data about pharma’s corporate reputation. For the latest edition 8 years of historical data are available.

Profile of 2018's respondent patient groups:

- 1500 respondent patient grouops - from 78 countries - covering 102 medical specialties - 61% are natinal patient groups and - 9% are international patient groups - Patient-group partnership with industry: 1218 of the 1500 respondent patient groups (81%) worked with/partnered with at least one pharma company 46 Pharma companies analysed: AbbVie I Acorda Therapeutics I Allergan I Almirall I Amgen I Astellas Pharma I AstraZeneca I Bayer I Bial I Biogen I Boehringer Ingelheim I Bristol-Myers Squibb I Celgene I Chiesi Farmaceutici I CSL Behring I Daiichi Sankyo I Eisai I Eli Lilly (Lilly) I Ferring I Gedeon Richter I Gilead I Grifols I Grünenthal I GSK I Ipsen I Janssen I LEO Pharma I Lundbeck I Menarini I Merck & Co (MSD outside of the US) I Merck KGaA/EMD Group I Novartis I Novo Nordisk I Octapharma I Otsuka I Pfizer I Pierre Fabre Laboratories I Roche (Genentech in the US) I Sanofi I Servier I Takeda (including Shire) I Teva I UCB I Vertex Pharmaceuticals I ViiV Healthcare PatientView has produced a separate analysis of the corporate reputation of 13 of the biggest of these 46 pharma companies, to enable peer-to-peer comparisons between the larger companies.

HOW DID THE INDUSTRY FAIRE? In 2018, patient-group attitudes towards the pharma industry as a whole remained on a par with those they held in 2017: - Patient groups viewed the corporate reputation of the pharma industry as largely unchanged in 2018 from 2017, with 41% of 2018’s respondent patient groups stating that the industry had an “Excellent” or “Good” corporate reputation, and ranking pharma 3rd out of nine healthcare sectors for corporate reputation. In 2017, 43% of respondent patient groups had thought that the pharma industry as a whole had an "Excellent" or "Good" corporate reputation.

- 53% of 2018’s respondent patient groups believed that the pharma industry was “Excellent” or “Good” at making high-quality products (a figure slightly down on the 57% of 2017).

- In 2018, only 9% of the respondent patient groups stated that pharma as a whole was “Excellent” or “Good” at having fair pricing policies. (This question was not asked in the 2017 survey, but the equivalent figure from the 2016 survey was 11%.) 2018 saw the beginning of President Trump’s Congressional hearing on drug pricing, with top drug executives providing testimony. Some pharma companies have responded to demands for lower prices in the US and elsewhere by publicly stating that they are stabilising annual price increases [for case studies from contributor companies, see the Global report's Appendix 1 supplement]. Other companies have not committed to such restrictions.

- PatientView’s ‘Patient Engagement in R&D: Still a Challenge’, published in December 2018, drew together the comments of thousands of patient groups on the subject of pharma’s engagement in R&D. From the feedback received, patient groups clearly feel that they (and the patients they represent) should be more actively engaged in the whole repertoire of activities that surround corporate R&D. Companies and regulatory agencies are trying to respond to the trend with the support of patient groups, through consortia like: • the European PARADIGM (Patients Active in Research Dialogues for an Improved Generation of Medicines); • the Food and Drug Administration’s PFDD (Patient Focused Drug Development); and • the global PFMD (Patient Focused Medicines Development). However, as shown by the answers to PatientView’s 2018 Corporate-Reputation question on the types of relationships that patient groups have with pharma [see accompanying figures], only a small fraction of the respondent patient groups that work with pharma have been engaged in the process of pharma R&D.

See further information in the original press release of PatientView here: http://bit.ly/pharmaCorpRep2018

|

Scooped by

rob halkes

|

The 'Corporate Reputation of Pharma in 2017' report is based on the findings of a PatientView November 2017-February 2018 survey exploring the views of 1,330 patient groups worldwide. The report provides feedback (from the perspective of these patient groups) on the corporate reputation of the pharma industry during 2017, as well as on the performance of46 pharma companies at 12 key indicators that influence corporate reputation.

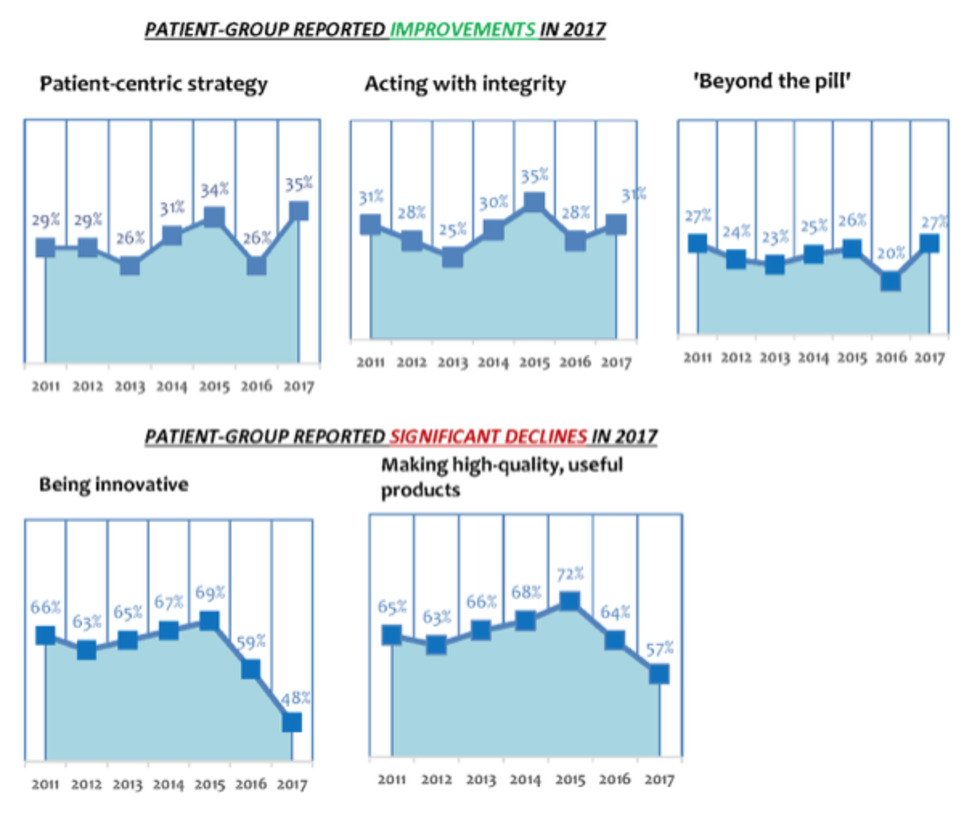

The Corporate-Reputation survey is now in its 7th edition—thus, 7 years of historical data are available. In addition, we incorporated several important new indicators of corporate reputation into the 2017 survey—to reflect the changing, and more demanding, relationships that now exist between patient groups and pharma companies. In 2017, patient-group attitudes towards pharma improved, after plummeting in 2016. 43% of respondent patient groups thought that the pharma industry had an "Excellent" or "Good" corporate reputation in 2017—against 38% of patient groups saying the same in 2016. In 2017, respondent patient groups ranked the pharma industry 3rd overall for corporate reputation out of 9 healthcare-industry sectors, the other sectors being: biotech; generic-drugs industry; health insurers (for-profit, and not-for-profit); medical-device industry; private-sector healthcare; and retail pharmacy. In 2016, patient groups ranked the pharmaceutical industry just 5th out of 9 healthcare sectors. PHARMA ALSO IMPROVED IN KEY ACTIVITIES IN 2017 ... 2017's respondent patient groups rated pharma as improving its performance over 2016 at three areas of activity important to patients and patient groups: patient centredness (35% of the patient groups stated that the industry was “Excellent” or “Good” at this activity, compared with just 26% in 2016); integrity (31% described the industry as “Excellent” or “Good” at this activity, compared with just 28% in 2016); and in services provided ‘beyond the pill' (27% thought industry “Excellent” or “Good” at this, compared with just 20% in 2016).

BUT ...

Respondent patient groups were far more negative in 2017 than in 2016 about several other pharma-industry activities. For instance, only 48% of 2017’s respondent patient groups judged pharma “Excellent” or “Good” at being innovative (down from 59% in 2016; which, in turn, was down from 69% in 2015). The 2017 figure is the lowest-reported percentage for the pharma industry's capacity to innovate since 2011 (when PatientView's Corporate-Reputation surveys began). Equally negative were 2017 attitudes towards the industry’s ability to make high-quality products. Only 57% of respondent patient groups in 2017 saw pharma as “Excellent” or “Good” at making high-quality products (down from 64% in 2016—which, was, in itself, also down from 72% in 2015). Again, the 2017 figure is the lowest-reported percentage for pharma and high-quality products since 2011.

It's my 71st birthday and I decided it's a good time for me to move on to a new role. Unbelievable, right? John "PharmaGuy" Mack is seventy-one years old!

Also unbelievable is that I am shuttering my pharmaceutical online publishing business after 16 years of continuous operation! There will be no more Pharma Industry News Update emails, no more PharmaGuy Insights on Scoop.it, and no new Pharma Marketing Blog posts. There will still be tweets from @pharmaguy, but eventually even that will end.

Although one door has closed, another door has opened for me as a Newtown Township, PA Supervisor. Yes, I am now a “politician!” I won the local election in November, 2017. In fact, I received more votes than any other candidate for local office (read about it here: “Mack Clobbers Couch!”).

These days it is especially important that citizens get reliable information from their leaders and get more involved in local government. That is my goal as well as “speaking truth to power,” which is what I have done in the pharmaceutical sector. Now I will be known as SupervisorGuy!

I have a lot to learn about my local township and how to govern. I feel energized like I did when I started writing about the drug industry. It will take all my effort to be successful in this endeavor and I simply won't have the time nor the energy to keep up with the drug industry.

PharmaGovernment Complex

Before I go, however, I’d like to say one or two words about what I call the “PharmaGovernment Complex,” which is the collusion between the pharmaceutical industry, lawmakers, and government agencies. In case any of you are interested in following my new career as a Township Supervisor, you can catch me “speaking truth to power” online: PharmaGuy aka SupervisorGuy

Via Pharma Guy

|

Scooped by

rob halkes

|

In the 2016-2017 round of its two annual surveys of corporate reputation—the corporate reputation of pharmaceutical companies, and the corporate reputation of medical-device companies—PatientView invited companies to contribute their thoughts on their own patient-related activities, 2016-2017.

The companies’ own comments comprise this publication, released in October 2017. Ten pharma companies (AbbVie, Bayer Vital Gmbh, Eisai, Janssen, LEO Pharma, Lundbeck, Novartis, Servier, Teva and ViiV Healthcare), and two medical-device companies (Coloplast and ConvaTec) offered contributions.

In addition, two of the pharma companies, Eisai and Janssen, offered country/market variations on their global patient-related activities (Eisai offered the patient-related activities of its Italy-based and USA-based arms, and Janssen, that of its UK arm). These companies answered the following questions posed to them: - Can you confirm which views you are expressing in this questionnaire for your company’s patient-related activities in 2016-2017?

- With how many patient organisations did your company partner in 2016-2017?

- What was the most common geographic remit of the patient organisations with which your company partnered in 2016-2017?

- Did your company partner in 2016-2017 with patient organisations whose specialisation(s) lies outside your therapy areas (TAs)?

- How does your company define the phrase ‘patient centricity’?

- How do good patient-organisation relations benefit your company?

- If you wish to highlight one of your key initiatives undertaken in 2016-2017 to improve patient-organisation relations, patient advocacy, or patient centricity, what is that initiative?

- What other patient-friendly activities did your company undertake in 2016-2017 that would be known to patient organisations familiar with your company?

- What are your company’s plans for improving its patient-organisation relations, its patient advocacy, or its patient centricity in 2017-2018 (from your perspective)?

- Finally, what do you foresee as likely to be the biggest obstacles that your company will face in having effective relationships with patient organisations during the forthcoming year (2017/2018)?

To obtain a copy of this report email: alexwyke@patient-view.com or report@patient-view.com

|

Scooped by

rob halkes

|

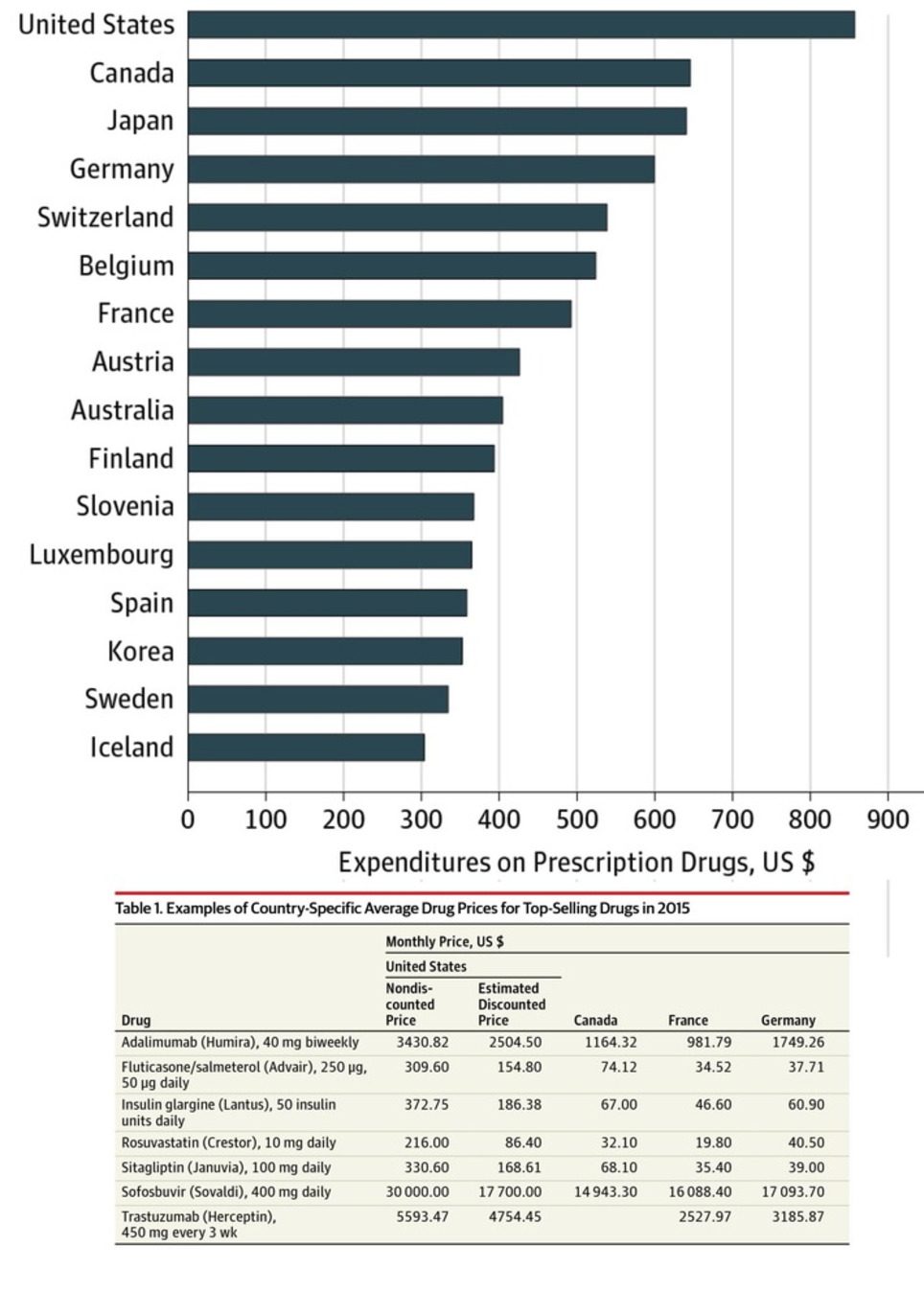

Here's a new report on the factors influencing drug expenditure, including the issues around pricing. It surely helps politicians and other stakeholders to understand the complexity of the pricing process pharma companies see themselves confronted with. Recent reports of increases in drug list prices and overall spend on medicines have put the spotlight on the cost of medicines in the U.S. The increasing list prices of specific medicines has, in particular, generated significant media attention. These messages have amplified concerns of policy makers, insurers, pharmacy benefit managers and other healthcare stakeholders that drug prices are to blame for rising costs in the U.S. healthcare system. However, much of the coverage on list prices has left out the more complex context of the prices, including - prices actually received by manufacturers or paid by intermediaries or patients

- the volume usage of the drugs in question

- the longer term context of the changes in a drug’s prices over time—including periods of price drops after patent protection

In this report you will find an in-depth analysis of the trends in medicine spending growth and manufacturer net revenues suggesting a far more complex situation than one of prices set by manufacturers simply being too high or growing too fast. In particular the report highlights the dynamics between prices and volume and introduces a novel way of combining market segments to consider the impact of patent expiry alongside other price related elements. The result is a clearer reflection of trends that affect the costs of medicines in the market. The report also notes that the trend of manufacturer revenues and patient costs are evolving in opposing directions, and that patient exposure to cost trends are not uniformly distributed across patients. Download

|

Scooped by

rob halkes

|

At next month’s Patient Summit Europe (19-20 October, London) find out how you can be more than a trusted partner – get yourself on the same side as your patients, and deliver sophisticated advocacy that fights their cause.

Patient advocacy groups and pharma companies have the same ultimate goal – better health outcomes – but managing these relationships needs care on both sides.

To give you an insight into the level of discussion you can expect at the summit, we spoke with:

- Nisith Kumar, Director, Global Patient Affairs, Pfizer

- Ann Kwong, Founder and CEO, TREK Therapeutics

- Lynn Bartnicki, Patient advocate, Living Beyond Breast Cancer

Read the article ‘Dancing to the same tune?’ here: https://goo.gl/hgVVms

Kind regards,

Cintia Hernandez Marco

|

Scooped by

rob halkes

|

While the level of drug expenditure is closely watched and often commented upon, the composition of that expenditure and its dynamics are less This report describes the dynamic changes in the composition of drug expenditure over the period 1995 to 2015 for five developed countries—France, Germany, Japan, the United Kingdom, and the United States. Over the past 20 years, therapies that once dominated spending are now dramatically less important, while other entirely new therapies have risen to a significant share of spending. Key insights include: - Nominal drug expenditure measured at invoice price level has risen substantially over the past 20 years across all countries analyzed, though less so when normalized for economic and population growth.

- When composition of drug expenditure is examined, the classes that dominated spending 20 years ago have shrunk considerably as innovation and product lifecycles shift costs downward.

- Older therapies have declining importance as many have lost patent protection and costs have reduced considerably, while others have seen continuous innovation and have risen in share of spending.

Across all five countries, some common patterns emerge in terms of the therapy areas that now make up the large portion of spending and those that have declined. That said, each country has a distinct set of dynamics, spending compositions, and underlying clinical, disease, and policy drivers. Download the report here

|

Scooped by

rob halkes

|

The number of women in power is on the rise in the pharmaceutical industry. Meet some of the leading ladies who are paving the way.

|

Scooped by

rob halkes

|

IFPMA » The Globalisation of the Pharmaceutical Industry Comprehensive study (Open Access see downloads) to update your insights into the industry.

|

Scooped by

rob halkes

|

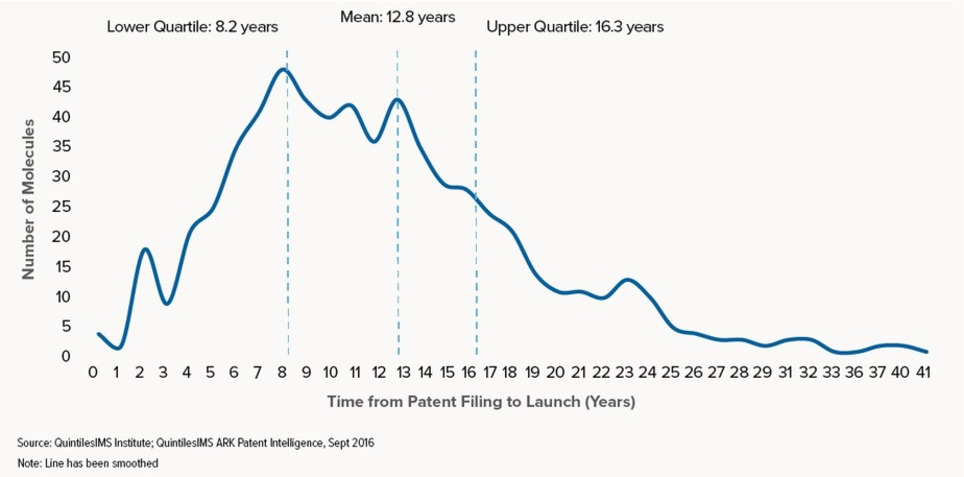

This report profiles the NASs launched in the U.S. over the past 20 years and measures the length of a molecule’s lifetime from patent filing to launch and eventual patent expiry. It also explores the significant variations in this lifetime when viewed by molecule characteristics such as therapy area, orphan drug status, and the type of companies involved in the development and marketing. Take a look at some of the coverage from the event in The Scientist, American Journal of Managed Care, and The Pharma Letter.

|

Scooped by

rob halkes

|

In a blog post in early 2016, the U.S. Food and Drug Administration Commissioner Dr. Robert M. Califf shared the agency’s intent to make 2016 “The Year of Diversity in Clinical Trials.” In doing so, Califf acknowledged FDA’s awareness that certain groups of patients may respond differently to different therapies and that “a wide range of people should have the opportunity to participate in trials, both for access to new therapies and to have the chance to contribute to better treatment of everyone.” As FDA notes, minorities—along with the elderly and women—have historically been underrepresented in clinical trials. African-Americans, for example, comprise 13.2 percent of the population, but only 5 percent of clinical trial participants, while Hispanic patients represent 16 percent of the population, but just 1 percent of participants. Meanwhile, Caucasians account for 67 percent of the population and 83 percent of research participants. Similarly, certain classes of hypertension drugs have recently been found to be less effective in African-American patients, while African-Americans with a certain common genetic variation require lower doses of the blood thinner warfarin compared with Caucasian patients. The inclusion of multiple ethnicities is essential in the clinical trial process for these reasons, and also because all patients should have equal access to opportunities for advanced care funded by clinical trial sponsors. Getting to the root of the problem The two primary reasons for low participation rates in clinical trials among minorities are feelings of mistrust among potential participants and an overall lack of awareness due to inefficient recruiting methods. Both of these issues need to be addressed to begin moving the dial on recruitment and enrollment of minority patients. The mistrust is based on a well-documented history of unethical clinical research, especially the U.S. Public Health Service’s Tuskegee syphilis study. The study induced 600 African-American men to participate in various experiments over a 40-year period. Participants who were diagnosed with syphilis were never informed of their condition, nor were they offered treatment. Many died of the disease, infected their wives, and/or passed congenital syphilis to their children. As a result, residual mistrust of clinical trials remains today among many members of the African-American community. Unfortunately, even though awareness of the need for more minority patients in clinical research has increased, traditional clinical trial recruiting methods have not been effective in terms of increasing the pool of minority participants. In fact, traditional recruitment methods that rely heavily on direct-to-consumer marketing such as Google ads and billboards to attract patients are failing to keep pace with trial demands in general—regardless of ethnic background. They fall even shorter when it comes to ensuring clinical trial diversity. Even with the widespread use of radio, television, and social media, nearly 70 percent of all clinical trials experience delays as a result of recruitment issues. How we can do a better job together As an industry, we need to do a better job informing potential participants of all racial and ethnic backgrounds about available clinical trials. At the company I lead, ePatientFinder, we have found that getting physicians more involved in the recruiting process, rather than relying on direct-to-consumer marketing, encourages greater patient access and participation. We recognize that community physicians have historically had little visibility into active studies, and we also have learned that patients are more likely to participate in clinical trials if their doctor recommends them. The wide-spread adoption of EHRs and the growing availability of sophisticated analytics is making it easier to leverage the trusted physician-patient relationship and more accurately and quickly identify protocol-eligible patients. Physicians can leverage these tools to identify potentially life-changing (or even life-saving) trials in the patient’s geographic area that offer opportunities for advanced care. Of course, this needs to be done in an HIPAA-compliant way, with patients opting in to have their medical records analyzed and matched with specific studies in their area for which they may be eligible, including any related to patient race and ethnicity. Patient outreach coordinators can then work with their physicians to pre-quality patients and connect them with the trial sponsors or contract research organizations (CROs) that are enrolling patients. Increasing access through bilingual initiatives This targeted approach is of particular value to patients who are non-native English speakers and who may have difficulty understanding the direct-to-patient recruitment messages that often appear in television commercials or in Internet ads. My company has started taking steps to increase access and break down barriers for minority patients who are not fluent in English, starting with Spanish-speaking patients. Some initiatives that are increasing access for these patients include offering screening questionnaires in both English and Spanish and hiring bilingual patient outreach coordinators to work directly with native Spanish-speakers. Patients are then able to discuss potential trial opportunities in Spanish and have a bilingual coordinator assist them in the enrollment process. Greater access for greater understanding Greater diversity in clinical trials is critical not only as related to equal access but also for understanding the full impact of different therapies and for ensuring their safety and effectiveness for people of all racial backgrounds. The best ways to achieve this are to increase access and awareness by adopting innovative approaches to patient recruitment that center on the trusted physician-patient relationship and leveraging EHRs and analytics to identify qualified patients.

|

Scooped by

rob halkes

|

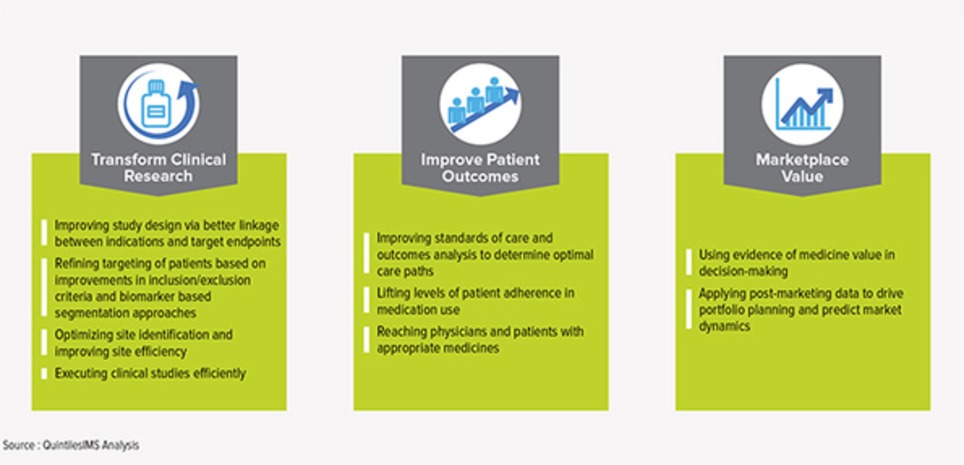

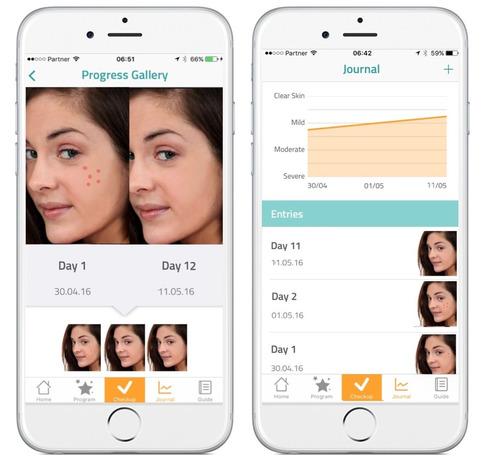

Mobile is encouraging healthy behavior Pharmaceutical manufacturers, payers and healthcare providers (HCPs)—as well as a host of tech-focused newcomers—are exploring digital programs that complement standard therapies and hold promise to keep patients healthier and produce better outcomes. Known as “beyond-the-pill” or “around-the-pill” services, they have been a long time coming, and may finally be gaining traction, according to a new eMarketer report,“US Healthcare Beyond the Pill: Digital Tech and New Partnerships Bring New Life to the Industry” (eMarketer PRO customers only).

For the past several years, healthcare and pharma firms have been trying, with mixed success, to step up their beyond-the-pill programs. Early efforts included basic informational websites and simple apps designed to provide information about medical conditions and therapies. “When the pharma industry first moved into digital technology, it was primarily in the marketing space, leveraging things like websites or HCP portals to share product information and to educate,” said Amy Landucci, head of digital medicine at Novartis. “But in the last three years, we’ve seen a pretty big shift away from just doing digital marketing—though it’s still very important—to looking at how technology can help enhance patient outcomes.” Today’s beyond-the-pill solutions can collect, monitor and analyze health-related information, track patient activity, improve medication adherence, provide personalized decision support, predict medical crises and streamline medical care using a variety of advanced computing techniques. Mobile technology, the IoT and AI are three of the technologies making this possible. Read one here Save

|

Scooped by

rob halkes

|

Like in most industries, players in the pharmaceutical world get a boost when customers the world over feel that they are innovators, act responsibly and are, generally speaking, a force for good. Recently a survey was published scoring exactly how good people in developed countries all over the world feel about big pharma.

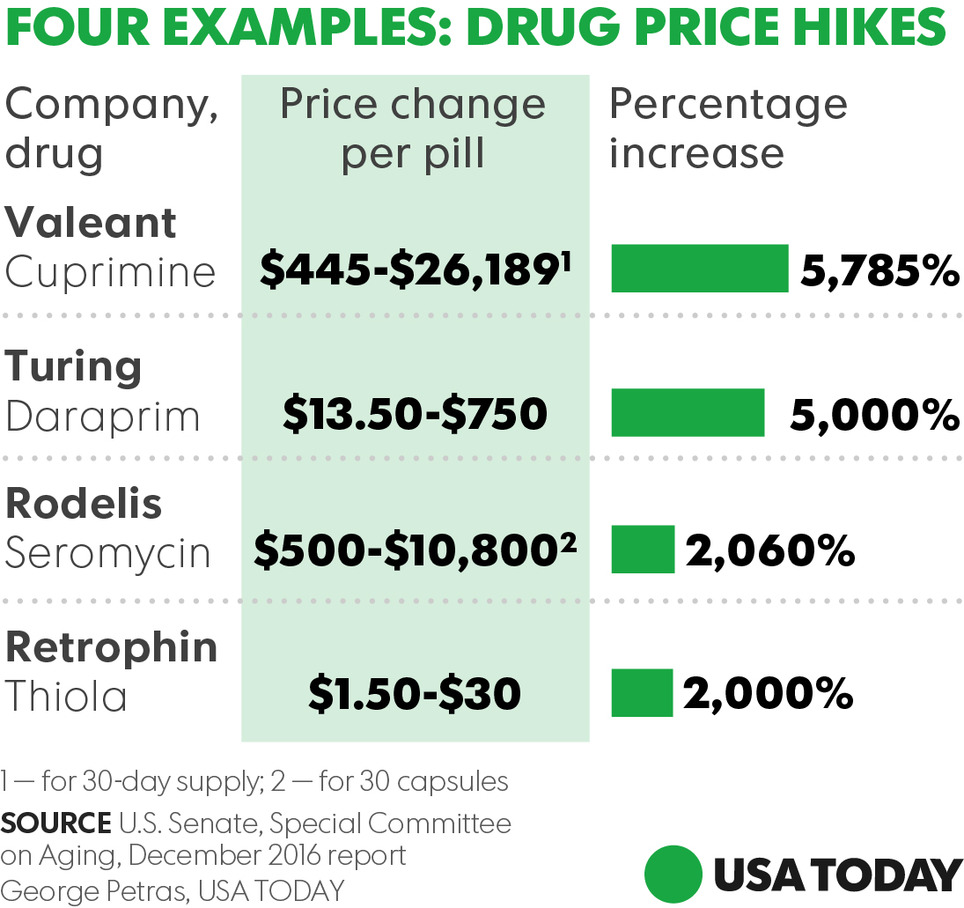

Staggering hikes — in some cases higher than 5000%— in prices of prescription drugs threaten the health and economic stability of Americans who can't afford vital medicines, a congressional report warned Wednesday. The findings by the Senate Special on Aging summarize the panel's 2016 investigation of records from four pharmaceutical companies and public hearings that focused on sudden price spikes in decades-old medications and the pricing decisions imposed by drug industry entrepreneur Martin Shkreli and other industry executives. Turing Pharmaceuticals and Retrophin (RTRX), two firms once headed by Shkreli, embattled drugmaker Valeant Pharmaceuticals International (VRX) and Rodelis Therapeutics are among companies that dramatically raised prices on some decades-old, off-patent drugs they acquired and controlled through monopoly business models, the report said. The Committee discovered that each of the four companies followed a business model (with some variation) that enabled them to identify and acquire off-patent sole-source drugs over which they could exercise de facto monopoly pricing power, and then impose and protect astronomical price increases. The business model consists of five central elements: - Sole-Source. The company acquired a sole-source drug, for which there was only one manufacturer, and therefore faces no immediate competition, maintaining monopoly power over its pricing.

- Gold Standard. The company ensured the drug was considered the gold standard—the best drug available for the condition it treats, ensuring that physicians would continue to prescribe the drug, even if the price increased.

- Small Market. The company selected a drug that served a small market, which were not attractive to competitors and which had dependent patient populations that were too small to organize effective opposition, giving the companies more latitude on pricing.

- Closed Distribution. The company controlled access to the drug through a closed distribution system or specialty pharmacy where a drug could not be obtained through normal channels, or the company used another means to make it difficult for competitors to enter the market.

- Price Gouging. Lastly, the company engaged in price gouging, maximizing profits by jacking up prices as high as possible. All of the drugs investigated had been off-patent for decades, and none of the four companies had invested a penny in research and development to create or to significantly improve the drugs. Further, the Committee found that the companies faced no meaningful increases in production or distribution costs.

Find the Senate report here.

Via Pharma Guy

While numerous congressional inquiries have purported to seek solutions or culprits for rising prescription drug prices, the American people appear to be placing the blame squarely on the laps of prescription drug manufacturers, according to a new survey released by the Pharmaceutical Care Management Association (PCMA). That survey, conducted for PCMA by North Star Opinion Research, found that three quarters of voters say the cost of prescription drugs is too high, and 55 percent said that drug companies are most to blame for high drug costs. Mark Merritt, president of PCMA, which represent the nation’s pharmacy benefit management (PBM) companies, pointed out that only 7 percent of Americans blame his association’s industry for high drug prices, despite the brand prescription drug manufacturers’ attempts to shift the blame to PBMs (read “Pharma CEO Rips Insurance CEOs a New One! Exposes Salaries, Blames Them for High Drug Prices”: http://sco.lt/6kN065 and Tracking Who Makes Money On A Brand-Name Drug”: http://sco.lt/7h31Ht). Further Reading:

Via Pharma Guy

|

Scooped by

rob halkes

|

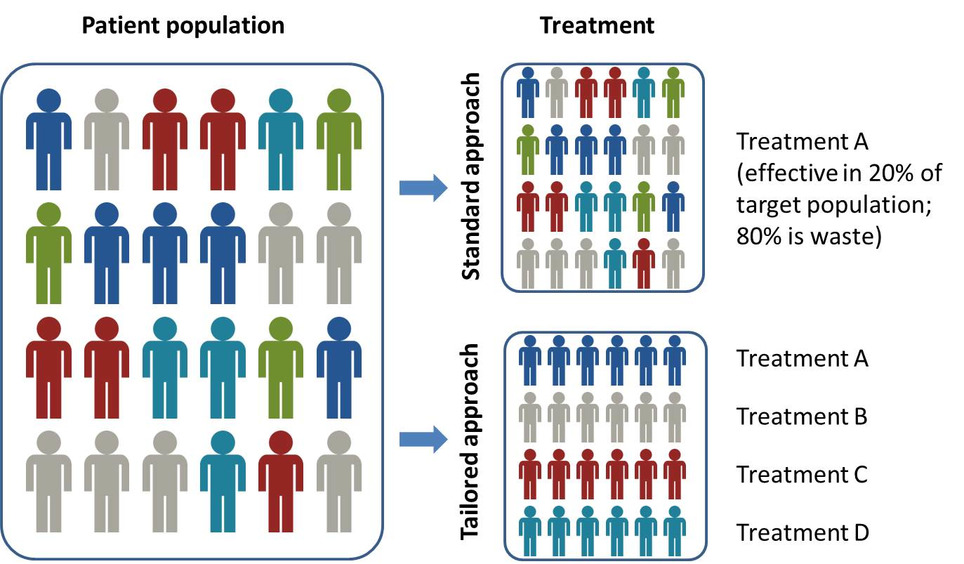

Precision medicine is significantly impacting pharma dealmaking, R&D and market access, according to a new report from Datamonitor Healthcare. Precision medicine is about more than molecularly targeted treatments. It increasingly refers to a far broader notion of getting the right therapy to the right patient at the right time, using any one or more of a multitude of tools and technologies. It is about getting better data about patients’ conditions, needs and lifestyles in order to allow the most appropriate treatment, and, ultimately, effective prevention strategies. Precision medicine is typically associated with the use of therapies that target particular disease-linked genetic mutations, identified via a diagnostic test. However, the term – sometimes used interchangeably with personalized medicine – has recently come to describe the much broader idea of getting the most appropriate therapy to the right patient at the right time, using any number of tools and technologies, whether molecular, digital, or other. Precision medicine has the potential to transform healthcare delivery, quality, and efficiency. It is already changing how pharmaceutical firms approach R&D, offering the prospect of being able to conduct faster, smaller, and cheaper trials. Yet the practice of precision medicine remains rare. Its widespread adoption faces scientific, infrastructural, economic, regulatory, educational, and commercial hurdles. While these are slowly being addressed, particularly in oncology, across most of healthcare, precision medicine remains tomorrow’s, rather than today’s, opportunity.

|

Scooped by

rob halkes

|

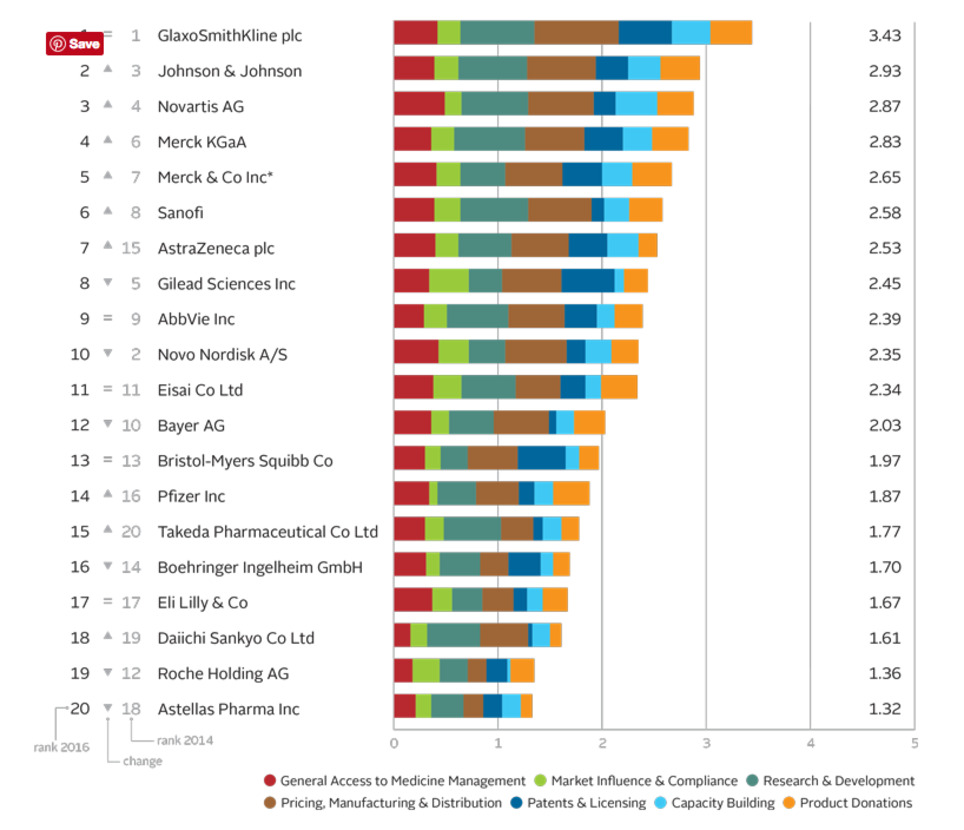

The Access to Medicine Index analyses the top 20 research-based pharmaceutical companies on how they make medicines, vaccines and diagnostics more accessible in low- and middle-income countries. 2016 Access to Medicine Index Overall Ranking In 2016 moderate progress is visible in the pharmaceutical industry’s efforts to improve access to medicine. GSK leads for the fifth time, ahead of Johnson & Johnson, Novartis and Merck KGaA.

Leaders see business rationale in access GSK leads for the fifth time ahead of Johnson & Johnson, Novartis and Merck KGaA. Critically, these companies show needs-orientation, matching actions to externally identified priorities in the access agenda. For example, they invest in R&D for urgently needed products, even where commercial incentives are lacking. Their access strategies support commercial objectives, with clear business rationales. Incremental improvements Lower ranked companies have each improved in at least one measure, and withstood closer scrutiny: the 2016 Index used tougher measures than in 2014. Change by these companies has been incremental. Exceptions are Takeda, which launched a new access strategy and rose from 20th place, and Bayer, which lost ground as others improved. In the top ten Following the first four, the remaining companies in the top ten each show strength in at least one area, yet have room to deepen engagement in access to medicine. There have been two significant shifts in this group. Novo Nordisk falls to 10th place. Its solid access frame- work applies to few products (albeit those considered key for access). AstraZeneca joins the top ten, with an expanded access strategy and notable pricing practices. Lowest rankings Lagging furthest behind are Roche** and Astellas. Roche is less transparent than its peers, yet it advances in other measures, with new access initiatives and strong processes for ensuring compliance. While Astellas shows some improvements, such as a new pledge not to enforce IP rights in certain poor countries, these were not sufficient to avoid being overtaken.

See the website for more! - Best practices - Company records Cards - Key findings etc.

|

Scooped by

rob halkes

|

Quintiles IMS Webinar: December 8th: Global Outlook for Medicines Through 2021 Join Murray Aitken and Michael Kleinrock for a webinar on December 8th to discuss findings from the much anticipated Global Outlook for Medicines through 2021 Report (to be released December 6th). During the webinar, they will share an updated perspective on - and the implications of - the use of new and existing medicines as well as spending levels and access constraints through 2021. The report focuses on a global view of the markets for all types of pharmaceuticals, including small and large molecules, brands and generics, those dispensed in retail pharmacies as well as those used in hospital or clinic settings. See this link December 8th Global Outlook for Medicines through 2021 Report (to be released December 6th).

|

Scooped by

rob halkes

|

This report explores how connecting disparate streams of data can create valuable insights that can make the difference in today’s biopharmaceutical marketplace. While these opportunities for connections exist across all disease and therapeutic areas, they may be most acutely needed in the complex and dynamic area of oncology. This report makes the case for the process by which a looming crisis in oncology can be averted, by applying the science—and art—of connecting healthcare insights.

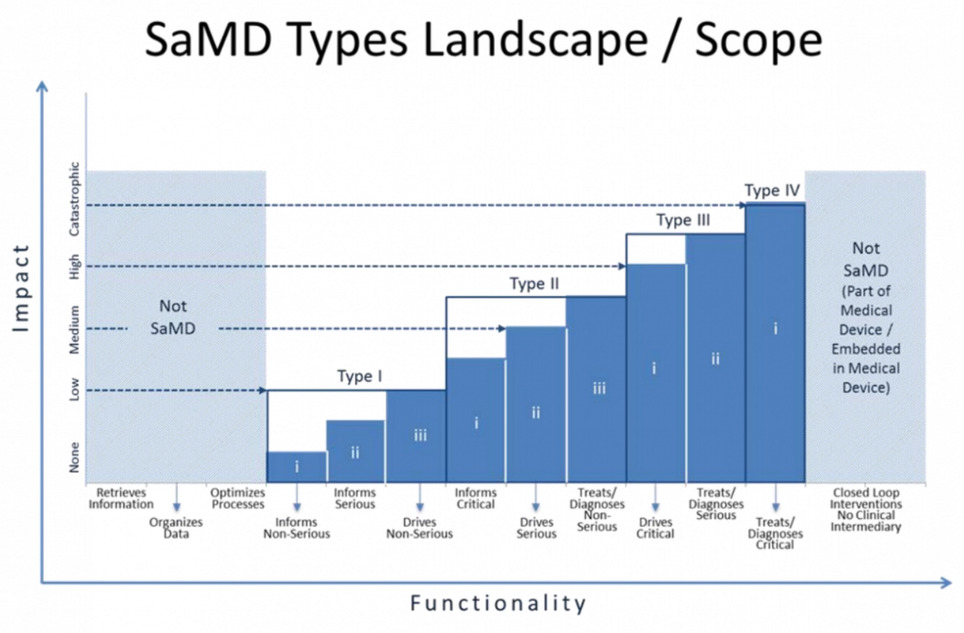

The FDA has entered into the federal register a new draft guidance pertaining to "software as a medical device" (SaMD). The guidance is presented as representing the FDA's current thinking on establishing clinical evaluation guidelines for SaMD, but is written by an international organization of device regulators, the International Medical Device Regulators Forum, of which FDA is a member. The guidance seeks to articulate what's new and different about SaMD (a category which would include mobile medical apps) and provide a stratified guidance on how to regulate different kinds of software and what kind of evidence is needed for each regulatory category. The guidance stratifies devices on two axes: whether the device informs care, drives care, or treats/diagnoses and whether the condition in question is non-serious, serious, or critical. So software that treats or diagnoses a critical condition is in the highest risk category, while software that informs care about a non-serious condition is in the lowest. The guidelines also call out and address the fact that software development tends to move faster than traditional medical device development and can more easily be influenced by postmarket data. "SaMD ... is unique in that it operates in a complex highly connected-interactive socio-technical environment in which frequent changes and modifications can be implemented more quickly and efficiently," the guidance says. "Development of SaMD is also heavily influenced by new entrants unfamiliar with medical device regulations and terminology developing a broad spectrum of applications."

Via Pharma Guy

|

Scooped by

rob halkes

|

Reports published in 2016 on the Corporate Reputation of Pharma, as viewed by over 1,000 patient groups The corporate Reputation of Pharma is growing:

In 2011 there was 42.0% of patient groups stating that the corporate reputation of the Pharma industry is "excellent" or "good". Although this percentage decreased to a 34% in 2012, it has increased ever since to 44.7% in 2015! For a quick summary about our methodology and series of reports on corporate reputation of pharma and medical devices view the powerpoint here Of course, this global indicators must be seen from the differentiated perspectives of regions and diseases! Reports of Pharma's Corporate Reputation over regions: GLOBAL, EUROPE and EASTERN Europe; GERMANY, ITALY, NORDIC, LATIN AMERICA, SPAIN, UK & USA Reports of Pharma's Corporate Reputation over therapeutic areas.: Cancer; Circulatory conditions; Diabetes; HIV/Aids; Hepatitis; Neurological conditions; Mental health; Skin; Respiratory and Rare diseases.

Reports for Respiratory and Circulatory conditions are forthcoming.

|

Scooped by

rob halkes

|

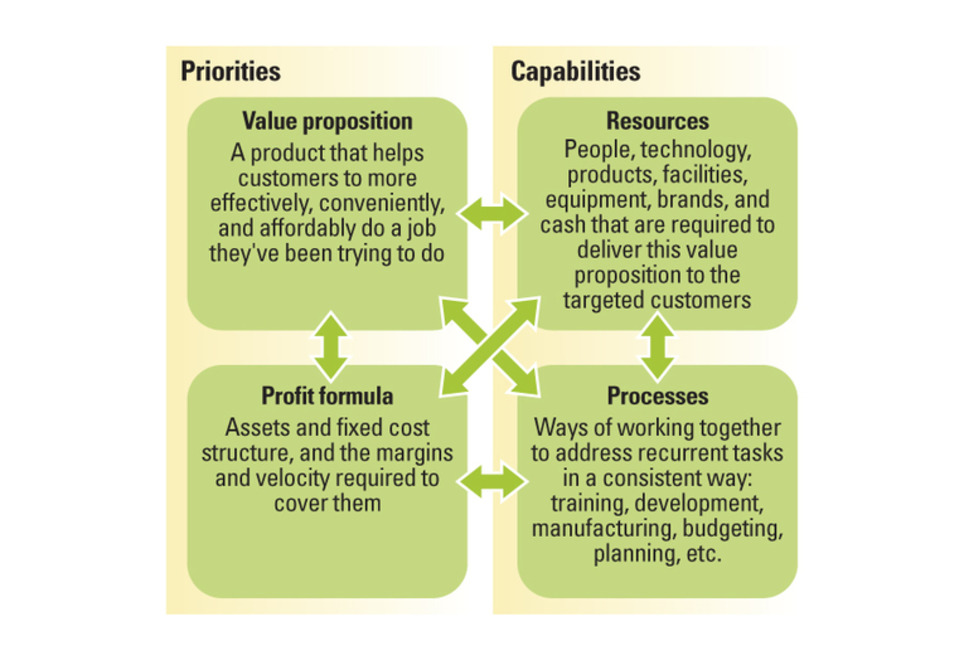

Successful business model innovation requires an understanding of how business models evolve. Many attempts at business model innovation fail. To change that, executives need to understand how business models develop through predictable stages over time — and then apply that understanding to key decisions about new business models. Understanding the interdependencies in a business model is important because those interdependencies grow and harden across time, creating another fundamental truth that is critical for leaders to understand: Business models by their very nature are designed not to change, and they become less flexible and more resistant to change as they develop over time. Leaders of the world’s best businesses should take special note, because the better your business model performs at its assigned task, the more interdependent and less capable of change it likely is. The strengthening of these interdependencies is not an intentional act by managers; rather, it comes from the emergence of processes that arise as the natural, collective response to recurrent activities. The longer a business unit exists, the more often it will confront similar problems and the more ingrained its approaches to solving those problems will become. We often refer to these ingrained approaches as a business’s “culture.”

|

Scooped by

rob halkes

|

EphMRA develops and improves standards and techniques for market research in Europe in the field of health and healthcare. EphMRA offers training and conferences for healthcare professionals. We are now inviting ideas for papers for the conference next year, 2017, and welcomes your submissions on a whole range of different topics. Below are some ideas for topics to get you started but we would be keen to hear from you if you have other ideas which you think will educate, inform and inspire colleagues working in our industry: - Innovative approaches

- How to increase the value of MR / BI

- Patient Insights

- Multi-disciplinary teams

- Analysis / Secondary data

- Data Collection

- Ideas for debates involving panels / audience participation

Please read more here about the Call for Contributors pdf which has all the information you need to make your submission. You will need to use the submission form - click here and we need your submissions by Monday 19 September so that the Programme Committee can review them all in October. All sessions will be 30 minutes in duration (25 minutes for presentation + 5 minutes for Q&A). If you require any further information, please contact either Bernadette Rogers - generalsecretary@ephmra.org or Caroline Snowdon - events@ephmra.org We look forward to hearing from you soon with your ideas.

|

Scooped by

rob halkes

|

FDA said it will ease up vetting general health and wellness apps, but it will scrutinize clinical applications and devices. Does this mean the FTC will step up? The U.S. Food and Drug Administration has issued final guidance on “low-risk” digital health apps and devices for general health management 18 months after it came out with draft guidance. The document offers information on the kinds of apps and devices for which it will and won’t take action. Apps promoting or maintaining a healthy weight or to assist with weight loss goals and healthy eating are OK. The guidance says that companies can make claims that their apps and devices can help with healthy lifestyle choices to reduce the risk of chronic conditions such as Type 2 diabetes, high blood pressure and heart disease or improve their management. But those lifestyle choices have to be advocated by the likes of the American Heart Association or American Association of Clinical Endocrinologist or peer-reviewed medical journals. So what are some examples of what’s not OK? Claims that a product will treat or diagnose obesity, an eating disorder, such as bullimia or anorexia, or an anxiety disorder. Digital health entrepreneurs are also encouraged to ask themselves the following questions: Is the product invasive?

Is the product implanted?

Does the product involve an intervention or technology that may pose a risk to

the safety of users and other persons if specific regulatory controls are not applied, such as risks from lasers or radiation exposure? If the answer is yes to any of the above, they need to assume their products are considered clinical applications, will be scrutinized and should act accordingly. My takeaway from the guidance is twofold. It’s a question of resources. Although there are thousands of general wellness apps, more and more medical device and pharma companies are developing digital health devices and apps of their own. Second, the Federal Trade Commission has shown it is willing to take action against companies that it deems to be making false health claims about their apps and devices.

|

Scooped by

rob halkes

|

The first half of 2015 continued to confound the naysayers of the pharma industry, with deal making, venture funding and share price indices all showing no signs of slowing down, according to EP Vantage's Pharma & Biotech Half-Year Review 2015. Key highlights The year started with one of the biggest venture rounds ever with the $450 million Moderna Therapeutics managed to secure from its investors in January VCs gifted $3.8 billion to companies at the half-year point signifying that 2015 could once again raise the bar in terms of funding totals On average, the 32 floats in 2015 yielded only a three percent discount from the listed range, and increased in value by 23 percent since their IPOs

See download the report

|

Your new post is loading...

Your new post is loading...

Pharma 2018/19 globally, looks to upgrade a bit of their Corporate Reputation. In general patients groups which are familiar and even working/partnering with at least one pharma company regard the company better. Partnering with patients works very well! Although the part of collaboration in research studies stays disappointingly low, it is one of the best ideas to a sustainable business for pharma.

As for their marketing and pricing efforts, only 9% of the respondent patient grooups stated that pharma as a whole was "excellent" or "good" at having fair pricing policies", which is lower than in 2017!

There looks to be a trend that more information and enghagement leads to better understanding and comprehension of policies.

If the current company executives take this to heart, it might even be that a common effort to pricing regulation renders a more quick result to agreements with health authorities and payers in matters of marketing access!

Do try a project on co-creating efforts with patients!

See http://www.healthbusinessconsult.com/co-creation-in-health-care/ and http://slidesha.re/11MagxG