The number of women in power is on the rise in the pharmaceutical industry. Meet some of the leading ladies who are paving the way.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Your new post is loading... Your new post is loading...

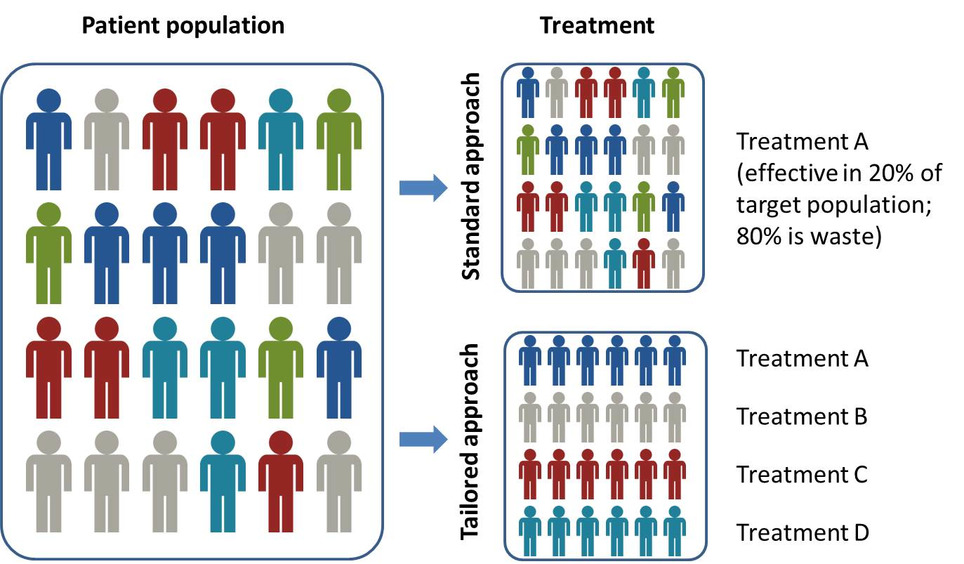

Precision medicine is significantly impacting pharma dealmaking, R&D and market access, according to a new report from Datamonitor Healthcare. Precision medicine is about more than molecularly targeted treatments. It increasingly refers to a far broader notion of getting the right therapy to the right patient at the right time, using any one or more of a multitude of tools and technologies. It is about getting better data about patients’ conditions, needs and lifestyles in order to allow the most appropriate treatment, and, ultimately, effective prevention strategies. Precision medicine is typically associated with the use of therapies that target particular disease-linked genetic mutations, identified via a diagnostic test. However, the term – sometimes used interchangeably with personalized medicine – has recently come to describe the much broader idea of getting the most appropriate therapy to the right patient at the right time, using any number of tools and technologies, whether molecular, digital, or other. Precision medicine has the potential to transform healthcare delivery, quality, and efficiency. It is already changing how pharmaceutical firms approach R&D, offering the prospect of being able to conduct faster, smaller, and cheaper trials. Yet the practice of precision medicine remains rare. Its widespread adoption faces scientific, infrastructural, economic, regulatory, educational, and commercial hurdles. While these are slowly being addressed, particularly in oncology, across most of healthcare, precision medicine remains tomorrow’s, rather than today’s, opportunity.

rob halkes's insight:

"Precision medicine" is very rich concept for new and better care, focused on better outcomes. The basic idea is clear and convincing. But is Health Care and health industry ready for it. We now see movements in the right direction in big pharma, specifically in oncology. The question remains: are all stakeholder going to benefit from this new perspective. Is it to be expected that all can gain as much as the patient? So, is it a viable strategy? We see already partnerships to be grounded. On the bright site we may expect that stakeholders in care will learn how to create a more patient (personal) focus and create better outcomes. But can any one tell if that's so?

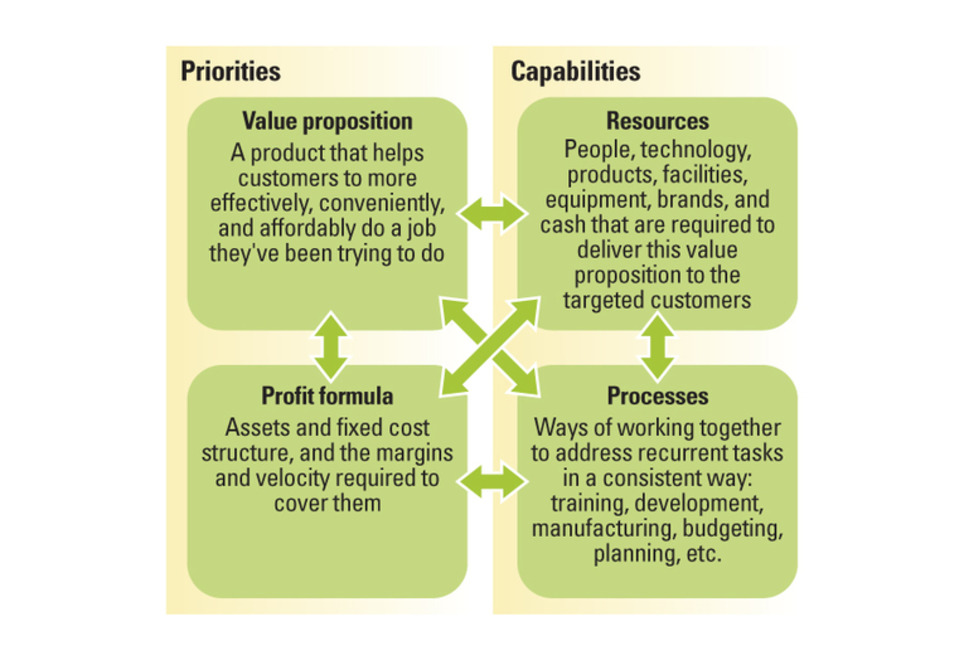

Successful business model innovation requires an understanding of how business models evolve. Many attempts at business model innovation fail. To change that, executives need to understand how business models develop through predictable stages over time — and then apply that understanding to key decisions about new business models. Understanding the interdependencies in a business model is important because those interdependencies grow and harden across time, creating another fundamental truth that is critical for leaders to understand: Business models by their very nature are designed not to change, and they become less flexible and more resistant to change as they develop over time. Leaders of the world’s best businesses should take special note, because the better your business model performs at its assigned task, the more interdependent and less capable of change it likely is. The strengthening of these interdependencies is not an intentional act by managers; rather, it comes from the emergence of processes that arise as the natural, collective response to recurrent activities. The longer a business unit exists, the more often it will confront similar problems and the more ingrained its approaches to solving those problems will become. We often refer to these ingrained approaches as a business’s “culture.”

rob halkes's insight:

Great article about business model innovation. I was struck by the resemblances of errors made at introducing new value added services to pharmaceuticals, "beyond the pill". The same may possibly be expected by the new "hype" (?) about patient centricity: in my mind doing things without reflection about what it is: ending up in webinars/conferences existing mainly of either pharma staff in which they share their ignorance, or even in pharma staff added with a patient or patient representative, in which the patient is commonly canonized (as in 'sainted'): understandable but not a functional way of developing new trends in a company, let alone a new trend in a business sector.. See here what patients really have to say about corporate pharma companies and its patient "centricity": PatientView.com

EphMRA develops and improves standards and techniques for market research in Europe in the field of health and healthcare. EphMRA offers training and conferences for healthcare professionals. We are now inviting ideas for papers for the conference next year, 2017, and welcomes your submissions on a whole range of different topics. Below are some ideas for topics to get you started but we would be keen to hear from you if you have other ideas which you think will educate, inform and inspire colleagues working in our industry:

Please read more here about the Call for Contributors pdf which has all the information you need to make your submission. You will need to use the submission form - click here and we need your submissions by Monday 19 September so that the Programme Committee can review them all in October. All sessions will be 30 minutes in duration (25 minutes for presentation + 5 minutes for Q&A). If you require any further information, please contact either Bernadette Rogers - generalsecretary@ephmra.org or Caroline Snowdon - events@ephmra.org We look forward to hearing from you soon with your ideas.

rob halkes's insight:

EphMRA, the European Pharmaceutical Market Research Association, is not only reflecting on the basics of its existence, but, in so doing, they are now embarking on a wider perspective on research in healthcare and healthcare markets (see here www.ephmra.org/EphMRA-Statutes ). This is reflected in its conference themes of 2017 for which the organization is now calling for papers.

Pharmaceutical companies can play a central role in the digital revolution of healthcare. But capturing this opportunity requires identifying the right initiatives. A McKinsey & Company article. Pharmaceutical companies are running hard to keep pace with changes brought about by digital technology. Mobile communications, the cloud, advanced analytics, and the Internet of Things are among the innovations that are starting to transform the healthcare industry in the ways they have already transformed the media, retail, and banking industries. Pharma executives are well aware of the disruptive potential and are experimenting with a wide range of digital initiatives. Yet many find it hard to determine what initiatives to scale up and how, as they are still unclear what digital success will look like five years from now. This article aims to remedy that. We believe disruptive trends indicate where digital technology will drive the most value in the pharmaceutical industry, and they should guide companies as they build a strategy for digital success.[ ..] Trends reshaping healthcare Patients are becoming more engaged [...] New competitors are moving in [...] More information is available about product performance [...] Process efficiency and agility is improving dramatically [...] Four areas of Digital Opportunity Against this backdrop, we believe there are four main areas where digital developments will drive value for pharma companies, building on what we see as the key components of digital success—an ability to deliver more personalized patient care, engage more fully with physicians and patients, use data to drive superior insight and decision making, and transform business processes to provide real-time responsiveness. Companies do not have to become leaders in all four areas across the enterprise—some will deliver more value than others in relation to any given disease, depending on market dynamics and their portfolio. But to decide where to concentrate their efforts, they do need to develop a point of view on each area’s potential to transform their commercial and innovation models. To help in these decisions, we sketch here a picture of how we believe successful pharma companies will operate in each area in the near future.

Most pharma companies have started to build some digital capabilities, but talent and resources for their efforts can be fragmented, often across hundreds of small initiatives. Without clear strategic direction and strong senior sponsorship, digital initiatives often struggle to secure the funding and human resources required to reach a viable scale, and they cannot overcome barriers related to inflexible legacy IT systems. Talent and partnerships are also critical issues—many companies realize they need to form partnerships to acquire digital capabilities and specialist skills but are often unclear about what kinds of partnerships to set up and how to extract value from them.

rob halkes's insight:

Pharma has to know explcity how "digital" is going to support their strategic developments, internally and externally. This article by McKinsey (mid 2015) declares how several market developments causes the need for digital. It will be in the "how" that a feeling of being disrupted will emerge. But a wisely designed implementation and development process will create miracles. Specifically so with an outcome at patient level. See some necessary steps here

From

hbr

For years, there has been a push within the pharmaceutical industry to move “beyond the pill” — in other words, to build and deploy complementary services and solutions to diversify revenue sources. The rationale is simple and elegant: A company with experience selling pharmaceutical products should be able to successfully and profitably sell its large customers (health plans, delivery systems, and governments) other health care offerings. The impetus to move beyond the pill typically arises from one or two realizations: 1) medicines alone are often not enough for patients to achieve optimal clinical outcomes, and 2) as pharmaceutical pipelines dry up, beyond-the-pill businesses can be valuable new sources of revenues. However, many beyond-the-pill efforts have sputtered or died. During my years working as a pharmaceutical industry executive and advisor to senior management, I have observed that these initiatives typically fail because of one of three challenges: Leadership.[..] Regulatory environment. [..] Access to capital [..] Recruit industry outsiders [..] Form partnerhsips [...] Revise regulations [...] Avoid stand alone solutions [...] Integrate clinical trials [...]

rob halkes's insight:

Inspiring article Sachin. Good to see how your experience in the field made you pick and select the best tips to go beyond the pill.

AstraZeneca is diving deeper into personalized healthcare with two projects that move the concept beyond cancer into respiratory disorders and heart disease. Personalized or precision medicine, which tailors treatment to a patient's genetic profile, is an increasing focus for drug companies, especially after an initiative from U.S. President Barack Obama in January. Until now, however, the focus has been on cancer, where genetic mutations are well-known drivers of disease. "The time is now right to extend the personalized healthcare approach and the benefits it brings to all of our therapy areas," Ruth March, who heads the initiative at the British drugmaker, told reporters. "Up to now the science of personalized healthcare has been slower to reach those common disease areas such as cardiovascular and respiratory disease." To redress the balance, AstraZeneca said on Wednesday it had signed two deals, one with Abbott Laboratories for a diagnostic test to accompany an experimental asthma drug and another with Canadian scientists on genes associated with heart disease. Abbott will develop a diagnostic test to identify patients with severe asthma who are most likely to benefit from AstraZeneca's new antibody drug tralokinumab, which is in final-stage Phase III clinical tests. To date, there are no such approved blood tests for use in asthma. A separate tie-up with the Montreal Heart Institute will screen samples from up to 80,000 patients for genetic traits linked to cardiovascular disease and diabetes, in a program that may help doctors work out which patient should take which drug. By 2020, AstraZeneca expects half of its new drug launches will come with so-called companion diagnostics to identify those patients most likely to benefit from different treatments. This approach is already used in cancer, with Roche's breast cancer drug Herceptin and AstraZeneca's lung cancer medicine Iressa, for example, given to patients with particular genetic profiles. Cancer has long been a key area for AstraZeneca, which was the target of a $118 billion attempted takeover last year by Pfizer. Along with rivals in the field, AstraZeneca will showcase its latest cancer drug advances at the May 29 to June 2 American Society of Clinical Oncology (ASCO) annual meeting in Chicago. Industry analysts say most attention will be focused on the latest clinical data on AstraZeneca's combination of two experimental medicines, MEDI4736 and tremelimumab, in treating lung cancer.

rob halkes's insight:

As we have noitfied in researching the developments of Pharma into Value Added Services (see here ), pharma companies are working to see how they can develop services to thealth care that could help the development of integrated care. One aspect we have seen accentuated by the interviewees was the necessity to create partnership with other stakeholders to combine needed competencies. AstraZeneca shows this by their latest partnerships with Abbott Laboratories and the Montreal Heart Institute. Beleive me: health care won't be the same anymore - although there is still along way to go!

rob halkes's insight:

Very insightful report about the mhealth market from a Pharma viewpoint says: publishing apps by pharma is not that easy, but has been done a lot. Learn from the information about their success!

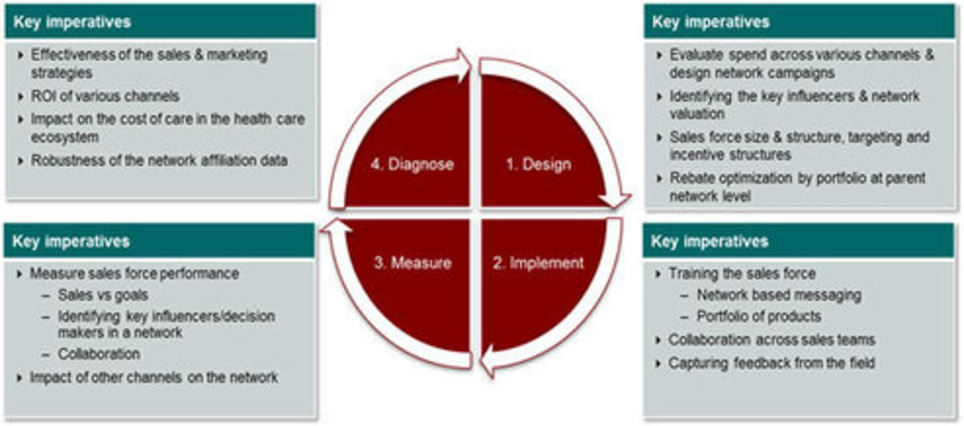

Integrated Delivery Networks (IDN) has resulted in a consolidated network for healthcare providers. Check out how this influences the decision sciences methodology for pharmaceutical companies. Why this is important Health care providers are undergoing a series of integrations that result in a consolidated network providing affordable and quality medical care –The IDN. Pharmaceutical companies need to evaluate their sales and marketing efforts and shift their focus from physician based selling to network based selling in order to tap the centralized decision makers. Over the past few years the pharmaceutical industry has viewed Physicians as one of the dominant entities influencing its success and growth. A physician reserved the autonomy on decisions concerning the choice of therapy for his patients and was subjected to influence mainly by peers (group-practices) and Industry leaders (KOLs). Consequently, all pharmaceutical companies focused their promotional and educational initiatives on physicians. Sales teams were determined to acquire the mind share of physicians which resulted in having to tap a large group of individuals in order to expect returns. However, this is becoming old school. The Evolving IndustryIn the recent past, Health Care providers (primarily hospital chains) have undergone a series of vertical and horizontal integrations. Vertical integrations included the acquisition of primary care physicians (PCPs), strategic alliances with physicians in physician-hospital organizations (PHOs) etc. On the other hand, horizontal integrations involved the establishment of multihospital systems, alliances with neighboring hospitals and mergers. Over time, such integrations have evolved and enhanced to what is today referred to as the Integrated Delivery Network (IDN). The integrations have resulted in the creation of a network of facilities and providers working together to offer a continuum of care. Prevailing economic market conditions and an array of healthcare reforms demands high quality of treatment at reduced costs (PPACA -2014). The very nature of integration allows IDNs to gain perspective on quality and cost factors that lead to better outcomes. This new vision focuses not only on intervention, but also on prevention and wellness, guiding patients to the most appropriate site of care, at the right time and cost. In short, IDNs are “Patient Centric” systems that act as ‘Islands of Excellence’ providing quality cost-effective treatments. Conventional WisdomOver the past few years the pharmaceutical industry has viewed Physicians as one of the dominant entities influencing its success and growth. A physician reserved the autonomy on decisions concerning the choice of therapy for his patients and was subjected to influence mainly by peers (group-practices) and Industry leaders (KOLs). Consequently, all pharmaceutical companies focused their promotional and educational initiatives on physicians. Sales teams were determined to acquire the mind share of physicians which resulted in having to tap a large group of individuals in order to expect returns. However, this is becoming old school. The Evolving IndustryIn the recent past, Health Care providers (primarily hospital chains) have undergone a series of vertical and horizontal integrations. Vertical integrations included the acquisition of primary care physicians (PCPs), strategic alliances with physicians in physician-hospital organizations (PHOs) etc. On the other hand, horizontal integrations involved the establishment of multihospital systems, alliances with neighboring hospitals and mergers. Over time, such integrations have evolved and enhanced to what is today referred to as the Integrated Delivery Network (IDN). The integrations have resulted in the creation of a network of facilities and providers working together to offer a continuum of care. Prevailing economic market conditions and an array of healthcare reforms demands high quality of treatment at reduced costs (PPACA -2014). The very nature of integration allows IDNs to gain perspective on quality and cost factors that lead to better outcomes. This new vision focuses not only on intervention, but also on prevention and wellness, guiding patients to the most appropriate site of care, at the right time and cost. In short, IDNs are “Patient Centric” systems that act as ‘Islands of Excellence’ providing quality cost-effective treatments.

rob halkes's insight:

In short: The world of health care is changing rapidly under the stres of more quality and volume for less costs of care. The formation of Integrated Delivery Networks (IDNs) will rise. To the health industry and pharma it means: if ou're not in, you're out and your competitor is in. This makes the need to change principles of market approach from a pharmaceutical company even higher. Don't you have a clue as to how: get in touch:

Abstract This study analyses how 14 OECD Countries refer to “value” when making decisions on reimbursement and prices of new medicines. It details the type of outcomes considered, the perspective and methods adopted for economic evaluation when used; and the consideration of budget impact. It describes which dimensions are taken into account in the assessment of “innovativeness” and the consequences of this assessment on prices; it confirms that treatments for severe and/or rare diseases are often more valued than others and shows how countries use product-specific agreements in an attempt to better align value and price. .. Conclusions The main objective of this report was to explore value-based pricing for pharmaceuticals. In principle, value-based pricing (VBP) can offer better value-for-money for purchasers of pharmaceuticals. It also gives clear signals to pharmaceutical companies that they will be rewarded if their products address the priorities of the purchasers, so in the longer run may reorient pharmaceutical innovation in a more cost- effective direction. However, it is easier to talk of rewarding ‘value’ than it is actually to do so. Is it value to the purchaser that should be the basis of decisions (i.e. some combination of the increase in health and the reduction in other health spending) or the value to society (which would also take into account increased labour force productivity of those who are less sick and those who no longer care for others, amongst other things)? Is there ‘value’ in innovation itself? Countries which use value-based pricing for pharmaceuticals do not make the same choices as to how to determine value. Furthermore, countries which do not have value-based pricing per se may take into account some of the elements used in economic assessments of value in making their decisions. This report attempts to shed light on what impact these different choices make to reimbursement decisions and prices. ... Read on in the downloadable PDF! Please cite this paper as: Paris, V. and A. Belloni (2013), “Value in Pharmaceutical Pricing”, OECD Health Working Papers, No. 63, OECD Publishing.

rob halkes's insight:

Very insightful research! Just for your appetite, I quote two relevant conclusions:

Social media is part of our culture. From sharing pictures, updates, and professional networking, to engaging customers and organizing political movements, there is no question about the power of social media. Interestingly, social media is still in its infancy and experts believe that the true potential and value of social media has not been tapped. Social media empowers everyone to share their ideas, amplify their voice, and shape the world. Healthcare professionals are using social media to share healthcare knowledge, advance patient care, and influence their professions. We profile 3 pharmacists actively using social media to build their businesses and advance the pharmacy profession. They are actively participating in the social economy. Via Marie Ennis-O'Connor

rob halkes's insight:

Pharmacists having a different business, do have in pricinple more time to work with patients to cope with their conditions and therapy demands. Would be great if it was self evident that cooperation of medical professionals (like doctor and pharmacist) comes standard!

rob halkes's insight:

John Mack, created a preso on his views of the nealry foregone year. Pharma has made a development indeed.

But has it gone as you expected it? I for one think not: acknowledging what new opportunities have arisen for pharma, stays a hard thing to do for management. The hardest thing? In my observation, as I can infer so from my discussions with them, is the (only partly) departure from calling routines as the major activity to market to promote one's products. All centres around developing e-detailing and with it larger connections to one's target groups. In the period from about 2007 till now, much has been published about the new business/commercial model for pharma. Recently we have completed a way to do so, with demonstrating data and all. Yet, it is still a long road to go, before we see pharma iinovate to real health care markets, indeed. Let's hope that 2013 makes a brea through!

All the best for the new year Rob @rohal

|

"The willingness to break out of the comfort zones" seems to be a critical attitude for women now in pharma top executive positions. Yet, I see from some of them how they had a career before that doesn't make their actual position a surprise. It is willingness from both sides: those who offer their prospects and those that hire them. Some is changing for the good in pharma: but are we in time? ...